Sellers, unlock your home's full potential and find more buyers

Does your home have a low interest rate mortgage? Buyers are urgently looking for homes like yours. Sell your home with an assumption and instantly increase your pool of buyers!

Find a certified agentWhy Sell With Exit Realty

3-5x the number of buyers that can afford your home

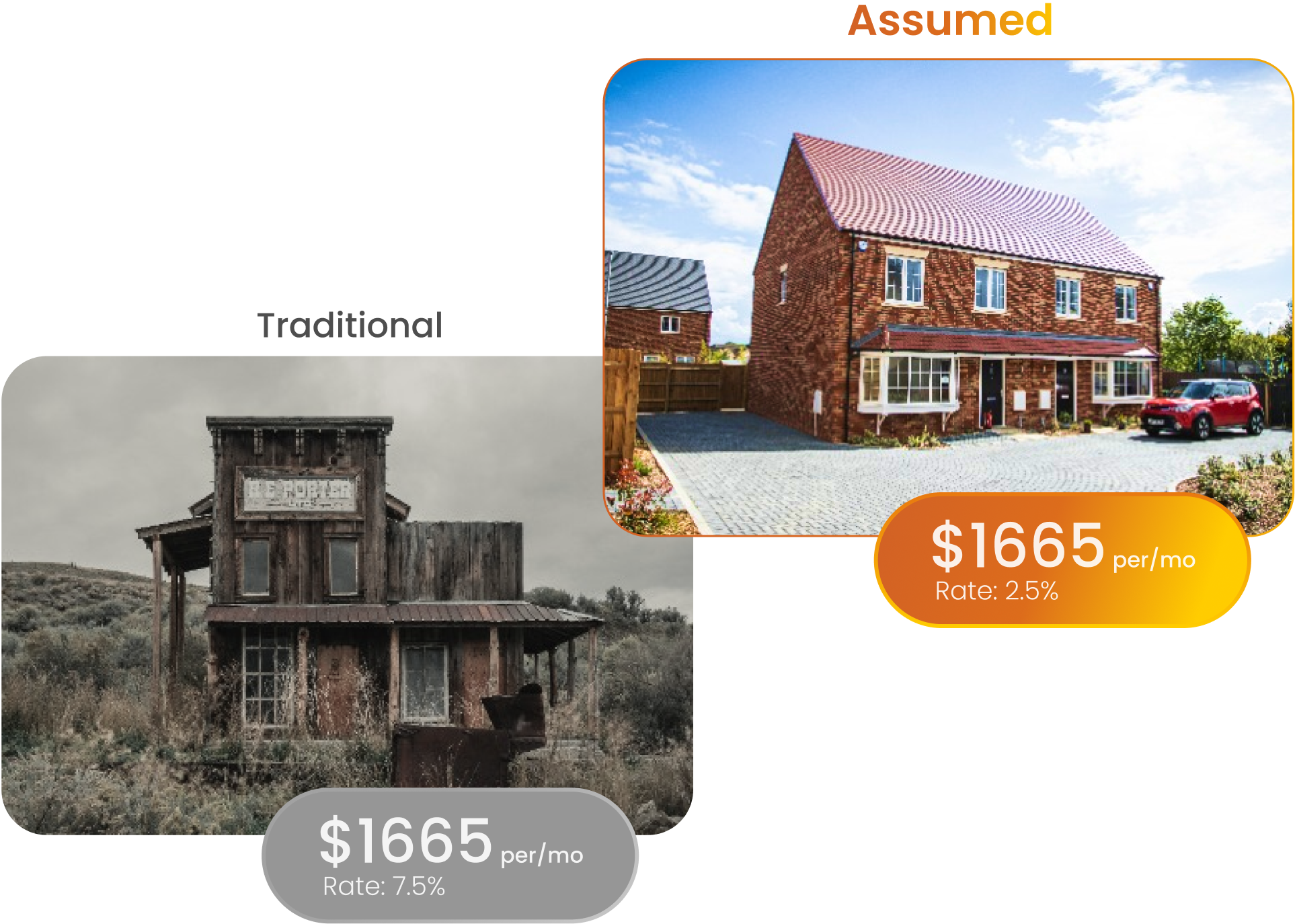

Selling your home with an assumable mortgage opens the door to a larger pool of qualified buyers. Unlike traditional mortgages based on loan amounts, assumable mortgages qualify buyers based on the monthly payment. With your low-rate, FHA or VA assumable mortgage, more buyers can afford your home!

List with a Exit Realty certified agent today and sell your home faster, potentially for more money, and with no additional fee.

Our Process

Selling Process With Exit Realty

Using Exit Realty to sell your home is simple and stress-free. We work with your agent to certify your home loan as assumable and market it accordingly. If you don’t have an agent, no problem! We can match you up with an experienced and local expert.

FHA and VA Assumable Mortgages

Both FHA and VA loans are assumable under most conditions. FHA loans are attractive for their lower rates and flexible eligibility, while assumable VA loans offer competitive rates - and you don't need to be a veteran to assume one! When considering an assumable mortgage, it is essential to understand the specific conditions and requirements for the assumption process of each loan type and that is where we come in.

Step 1

Get your loan certified by us!

We work directly with your loan servicer to gather all necessary assumption details specific to your loan.

Step 2

Find more buyers

List your home with a one of our certified agents and showcase the advantage of a low-rate, assumable mortgage. Our marketing strategies target and educate buyers actively seeking homes with favorable financing options, maximizing your home's visibility and appeal in assumable mortgage listings.

Step 3

Sit back and relax

We take care of working with your agent, the loan servicer, and the buyers….so you don't have to.

Step 4

Get your money

Once sold, receive the proceeds directly in your account. Congratulations on making a smart decision to sell your home faster and at a greater profit with us!

What is an assumable mortgage?

An assumable mortgage allows you to take over the seller's existing loan, including its current interest rate and terms. This can lead to substantial savings, particularly in a high-interest rate market. UMe's expertise in assumable mortgages ensures you navigate this process seamlessly, securing the best deal possible.

Lower Interest Rates

If the current mortgage rate is lower than current market rates, assuming the mortgage allows the buyer to inherit this lower rate, resulting in lower monthly payments and overall interest costs.

Reduced Closing Costs

Assumable mortgages often have lower closing costs compared to taking out a new mortgage, as there's often no need for a new appraisal, loan origination points or fees, or other associated costs.

Easier Qualification

Assuming a mortgage can be easier than qualifying for a new mortgage, especially for buyers who might not meet today's stricter lending criteria or have less-than-perfect credit.

Flexibility For Sellers

For sellers, having an assumable mortgage can make their property more attractive to potential buyers. This increased pool of qualified buyers can lead to a quicker and more profitable sale.

Do You Have Any Questions?

Check out this FAQ to get more informationFollow Us

Agent/Broker

Jeff KlemmerExit Realty(651) 600-7997assumptions@exitspringside.comMLS #40195899Resources

Apply to AssumePowered By UMe.

© Listing Service, All rights reserved. The data relating to real estate for sale on this website comes in part from the Listing Service. Real estate listings held by brokerage firms other than Exit Realty are marked with the Listing Service logo and detailed information about them includes the name of the listing brokers. All information deemed reliable but not guaranteed and should be independently verified. All properties are subject to prior sale, change or withdrawal. Neither listing broker(s) nor Listing Service shall be responsible for any typographical errors, misinformation, misprints and shall be held totally harmless.

Exit Realty © is committed to and abides by the Fair Housing Act of Equal Opportunity.